In today’s fast-paced financial markets, futures trading apps have become indispensable tools for both beginner and professional traders. With technology advancing rapidly, traders no longer need to rely solely on traditional brokers. Instead, they can execute trades instantly from their smartphones, access real-time data, and employ advanced charting features. In this comprehensive guide, we explore the best futures trading apps, their essential features, and how they can enhance your trading experience.

What Is a Futures Trading App?

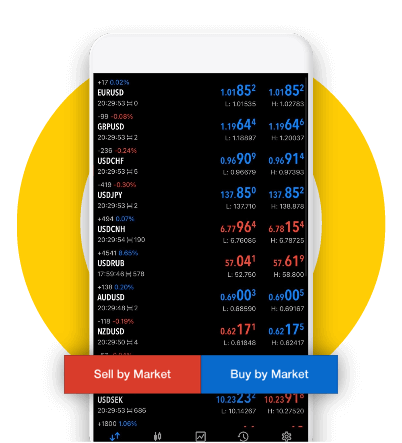

A futures trading app is a mobile application that allows traders to buy and sell futures contracts in global markets. These apps provide real-time quotes, charting tools, margin management, and execution capabilities, ensuring that traders can make informed decisions on the go. With the rise of algorithmic and AI-driven trading, these apps have evolved into all-in-one platforms where research, risk management, and order execution seamlessly integrate.

Why Choose a Futures Trading App?

Futures trading requires precision, speed, and accessibility, and mobile apps provide exactly that. Some of the main benefits include:

- Real-time market data: Access to live quotes and charts.

- Seamless execution: Place orders instantly with one tap.

- Advanced charting tools: Technical indicators, drawing tools, and customizable timeframes.

- Portfolio management: Track open positions, P&L, and margin requirements.

- Accessibility: Trade from anywhere, anytime.

These advantages make trading apps a must-have in today’s financial ecosystem.

Top Features to Look for in a Futures Trading App

Not all apps are created equal. When choosing a futures trading app, consider these must-have features:

1. Real-Time Data and Charting

A powerful futures trading app must provide accurate, real-time quotes and advanced charting options. This ensures that traders can identify trends, analyze volatility, and execute strategies effectively.

2. User-Friendly Interface

The interface should be intuitive and easy to navigate, reducing errors and enabling quick order placement.

3. Advanced Order Types

Support for order types such as market, limit, stop, OCO (One-Cancels-Other), and trailing stops is essential for risk management.

4. Security and Regulation

Since futures involve real capital, security features like two-factor authentication (2FA), encryption, and regulatory compliance are crucial.

5. Research and Analytics Tools

The best apps integrate news feeds, technical indicators, and economic calendars, giving traders a comprehensive decision-making toolkit.

6. Integration with Desktop Platforms

Professional traders often use multiple devices. Apps that sync with desktop versions allow seamless transitions between mobile and PC trading.

Best Futures Trading Apps in 2025

Here are some of the leading futures trading apps that stand out in terms of reliability, features, and user experience:

1. Thinkorswim by TD Ameritrade

Thinkorswim offers advanced charting tools, customizable layouts, and paper trading features. It’s ideal for both beginners and advanced traders who need sophisticated analytics.

2. NinjaTrader Mobile

Known for low commissions and advanced order management, NinjaTrader is a go-to app for active futures traders. It integrates with powerful desktop features for seamless trading.

3. TradeStation Futures App

TradeStation provides real-time market data, strategy backtesting, and robust technical analysis tools. Its mobile app ensures smooth order execution with professional-grade features.

4. Interactive Brokers Mobile (IBKR)

IBKR’s mobile app is perfect for global traders, offering access to multiple markets, competitive commissions, and professional-grade research tools.

5. E*TRADE Futures App

E*TRADE is known for ease of use, built-in educational resources, and comprehensive futures trading features, making it a strong option for beginners.

How to Start Trading Futures with an App

Starting with a futures trading app is straightforward. Follow these steps:

- Choose a broker: Select a broker that offers a reliable app with strong futures trading capabilities.

- Open an account: Complete KYC and funding requirements.

- Download the app: Install the broker’s official futures trading app on your device.

- Fund your account: Deposit initial capital according to the broker’s requirements.

- Learn the tools: Explore demo or paper trading features to understand the app’s functions.

- Start trading: Place small trades first, focusing on learning risk management.

Futures Trading Strategies to Apply with Apps

Using an app alone isn’t enough. A strong trading strategy ensures success. Popular strategies include:

- Scalping: Executing quick trades to capture small price movements.

- Day Trading: Entering and closing positions within the same day.

- Swing Trading: Holding contracts for several days to capture larger market swings.

- Hedging: Using futures to protect against adverse movements in other investments.

- Trend Following: Leveraging technical indicators to trade with the prevailing trend.

Each of these strategies can be executed seamlessly through mobile apps with the right tools.

Risks of Futures Trading Apps

While futures trading apps offer numerous advantages, there are also risks to consider:

- High leverage exposure: Futures involve significant leverage, increasing both profit and loss potential.

- Market volatility: Rapid price movements can trigger stop-outs if not managed carefully.

- Overtrading: Easy access via mobile can lead to excessive trading without proper discipline.

- Technical issues: Poor internet connection or app glitches may cause delayed executions.

Understanding these risks and applying strong risk management techniques is vital for sustainable trading.

The Future of Futures Trading Apps

With the integration of AI, machine learning, and blockchain technology, the next generation of futures trading apps will be even more powerful. We expect:

- AI-powered trade suggestions

- Voice-activated trading commands

- Blockchain-based settlement systems

- Deeper personalization through predictive analytics

These advancements will make trading faster, safer, and more efficient than ever before.

Conclusion

A futures trading app is no longer a luxury—it’s a necessity for modern traders. By offering real-time data, advanced charting, and seamless execution, these apps empower traders to navigate volatile markets effectively. Whether you’re a beginner learning through paper trading or an advanced professional managing complex strategies, the right app can significantly enhance your success in futures markets.