In the dynamic and often complex world of online trading, demo accounts on trading platforms have become an indispensable tool for traders at every level. Whether you are a novice just stepping into the world of financial markets or an experienced trader testing new strategies, trading platforms with demo accounts provide a risk-free environment to learn, practice, and refine your trading skills.

What Are Trading Platforms with Demo Accounts?

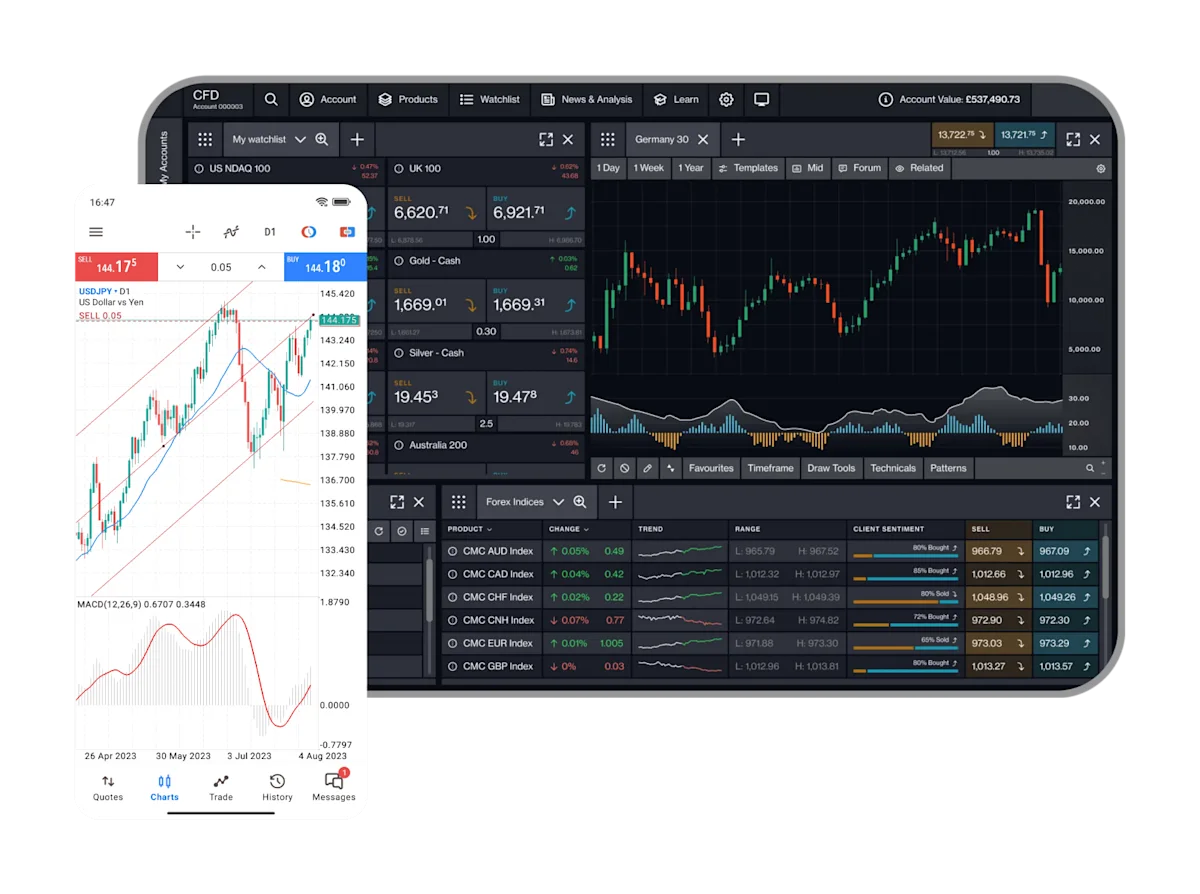

Trading platforms with demo accounts are online trading services that offer users a simulated trading environment. These accounts mirror real-market conditions, including live price feeds, charts, and order execution, but use virtual funds instead of real money. This allows traders to experience the platform’s features and test strategies without risking their capital.

Why Are Demo Accounts Essential for Traders?

The benefits of using demo accounts on trading platforms cannot be overstated. Here’s why:

1. Risk-Free Practice Environment

A demo account allows traders to familiarize themselves with the trading platform’s interface, order types, and execution speeds. Beginners can practice opening and closing trades without any financial risk, which builds their confidence before transitioning to live trading.

2. Strategy Development and Testing

Experienced traders can use demo accounts to back-test and forward-test trading strategies in real-time market conditions. This is crucial to ensure the effectiveness of strategies before applying them to live accounts, reducing the risk of significant losses.

3. Understanding Market Dynamics

The simulated environment helps traders grasp the nuances of market movements, volatility, and execution delays. It acts as an educational tool, helping users understand technical analysis, chart patterns, and the impact of news events without financial pressure.

4. Platform Familiarization

Each trading platform has unique features, tools, and navigation styles. Demo accounts provide an opportunity to explore these features thoroughly, including the use of technical indicators, automated trading bots, and order management tools.

Top Features to Look for in Trading Platforms with Demo Accounts

When selecting a trading platform with a demo account, certain features are critical to ensure a smooth and productive experience.

1. Realistic Market Conditions

The demo account should simulate real market prices and spreads. This ensures that users get an authentic experience that closely resembles live trading conditions.

2. Sufficient Virtual Capital

Platforms offering large virtual balances give traders the freedom to place trades of various sizes and try out multiple strategies without limitations.

3. Access to Full Trading Tools

A demo account should provide access to all the tools available in the live account, including charting software, technical indicators, and market news feeds.

4. No Time Limits

Some platforms restrict the use of demo accounts to a limited time frame. Ideally, demo accounts should be available indefinitely to allow traders to practice as much as they want.

5. Multi-Device Compatibility

With the rise of mobile trading, the platform should offer demo accounts that work seamlessly on desktops, smartphones, and tablets.

Popular Trading Platforms Offering Demo Accounts

MetaTrader 4 and MetaTrader 5

MetaTrader platforms remain industry standards, offering highly customizable demo accounts with access to real-time price data, automated trading through Expert Advisors (EAs), and advanced charting tools. Their popularity stems from the vast community support and availability across brokers.

eToro

eToro’s demo account is favored for its social trading features, allowing users to practice copying trades from successful traders while learning the platform’s unique interface.

Interactive Brokers

Renowned for professional-grade trading, Interactive Brokers offers demo accounts with access to multiple asset classes, including stocks, forex, options, and futures, making it ideal for diversified trading practice.

Thinkorswim by TD Ameritrade

Thinkorswim’s demo account is comprehensive, with powerful analytics and paper trading options that mirror professional environments, perfect for traders focused on technical and options trading.

Plus500

Known for its simplicity, Plus500 offers a straightforward demo account with unlimited virtual funds and access to CFDs on a wide range of assets, ideal for beginner traders.

How to Maximize the Benefits of a Demo Account

To fully leverage a demo account, consider the following best practices:

1. Treat It Like Real Trading

Adopt a disciplined approach. Set realistic goals, use proper risk management techniques, and avoid reckless trading just because it’s virtual money.

2. Keep a Trading Journal

Document every trade you place — entry, exit, reasons for the trade, and outcomes. This helps in analyzing performance and identifying areas for improvement.

3. Test Different Markets

Explore trading various asset classes such as forex, stocks, commodities, and cryptocurrencies to understand where your strengths and preferences lie.

4. Simulate Live Conditions

Try to replicate live trading environments by factoring in slippage, spreads, and market volatility in your demo trades to prepare for real-market challenges.

5. Use the Demo to Learn the Platform’s Features

Spend time exploring all the tools and settings of the platform to enhance your trading efficiency and speed.

Common Misconceptions About Demo Accounts

“Demo Trading Is Too Easy”

Many believe that trading with virtual funds is simpler because there’s no emotional pressure. However, this overlooks the critical learning opportunity demo accounts provide in mastering technical skills and platform navigation.

“Success in Demo Guarantees Success Live”

While demo accounts are vital, live trading involves psychological factors like fear and greed. Transitioning from demo to real requires additional mental preparation.

“Demo Accounts Are Limited in Functionality”

Quality demo accounts offered by leading platforms provide full functionality mirroring live accounts, making them excellent training grounds.

The Future of Trading Platforms with Demo Accounts

With technology advancing rapidly, demo accounts are becoming more sophisticated. Integration of artificial intelligence, machine learning, and enhanced analytics are empowering traders to simulate complex trading environments. Virtual and augmented reality are also on the horizon, promising immersive demo experiences.

Moreover, regulatory bodies increasingly recognize demo accounts as vital educational tools, encouraging brokers to offer comprehensive demo features for responsible trading.

Conclusion

Trading platforms with demo accounts serve as the foundation for building trading competence and confidence. They offer an unmatched risk-free environment to hone skills, test strategies, and get familiar with trading tools. By selecting the right platform and adopting disciplined trading practices within the demo environment, traders significantly improve their chances of success in live markets.