In the dynamic world of options trading, gaining practical experience without risking real capital is essential—especially for beginners and traders testing new strategies. Webull option paper trading provides an ideal solution, offering a risk-free, simulated environment where traders can practice options trading with virtual funds while experiencing real-time market conditions.

This article explores everything you need to know about Webull’s option paper trading feature, its benefits, how to use it effectively, and why it’s a top choice for options traders looking to refine their skills.

What Is Webull Option Paper Trading?

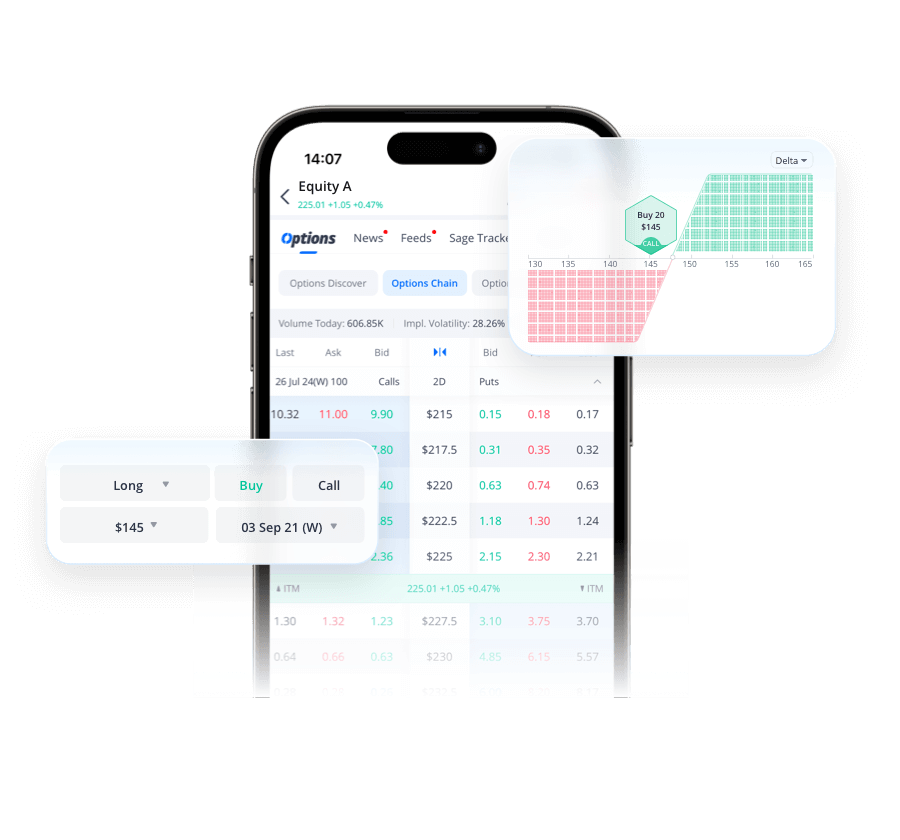

Webull option paper trading is a simulation tool integrated into the Webull trading platform that enables users to practice options trading using virtual money. It mimics real options markets, allowing traders to place and manage option contracts on stocks, indices, and ETFs without any financial risk.

This tool is especially beneficial for:

- New traders learning the complexities of options trading.

- Experienced traders testing new strategies without risking real capital.

- Investors wanting to familiarize themselves with Webull’s platform functionalities.

Key Features of Webull Option Paper Trading

1. Real-Time Market Data

Webull provides real-time options pricing and market data within the paper trading environment. This ensures that your simulated trades reflect actual market conditions, enabling realistic practice.

2. Wide Range of Options

The platform offers access to a broad universe of options contracts, including calls, puts, spreads, and multi-leg strategies on numerous stocks and ETFs.

3. User-Friendly Interface

Webull’s intuitive mobile and desktop interfaces make navigating options chains, placing trades, and managing positions simple for traders of all levels.

4. No Cost, No Risk

The paper trading account is completely free and uses virtual money, eliminating financial risk while offering a fully functional trading experience.

5. Portfolio Tracking and Analytics

Users can monitor their paper trading portfolio performance, analyze trades, and review P&L metrics, helping to identify strengths and weaknesses in their strategies.

Benefits of Using Webull Option Paper Trading

Safe Learning Environment

Options trading involves complexities such as expiration dates, strike prices, and implied volatility. Webull’s paper trading environment allows users to grasp these concepts in a risk-free setting before committing real capital.

Strategy Testing and Refinement

With the ability to execute various option strategies, including complex spreads, traders can experiment and fine-tune their approaches, improving their chances of success when trading live.

Builds Confidence and Discipline

Regular practice with paper trading helps build the confidence needed to execute trades calmly and effectively in real markets. It also promotes the discipline required to stick to trading plans.

Platform Familiarity

New users can familiarize themselves with Webull’s platform features and tools, reducing errors and enhancing efficiency when transitioning to live trading.

How to Get Started with Webull Option Paper Trading

Step 1: Create a Webull Account

Sign up for a free Webull account via the website or mobile app. You do not need to fund your account to access paper trading features.

Step 2: Access the Paper Trading Mode

Log into Webull and switch to the paper trading mode by selecting the “Paper Trading” option. This activates the simulated trading environment.

Step 3: Explore the Options Chain

Navigate to the options tab of any stock or ETF and view available contracts. Analyze the options chain to select contracts based on strike price and expiration dates.

Step 4: Place Simulated Trades

Place buy or sell orders for option contracts just as you would in a live account. Monitor order execution, adjust positions, and track your virtual portfolio.

Step 5: Review and Analyze

Use Webull’s portfolio tracking and analytics tools to review your trades, analyze profitability, and learn from your trading decisions.

Tips for Maximizing Your Webull Option Paper Trading Experience

- Treat Paper Trades Like Real Trades: Apply real risk management rules and position sizing.

- Experiment with Different Strategies: Try basic options like calls and puts, as well as advanced strategies like spreads and straddles.

- Maintain a Trading Journal: Document trades, rationale, and outcomes to identify patterns and improve.

- Stay Updated: Use Webull’s integrated news and market data to simulate real-world decision-making.

Conclusion

Webull option paper trading is an excellent resource for traders at all levels to practice options trading without risking real money. By leveraging this free, real-time simulated environment, traders can develop strategies, build confidence, and become proficient with the Webull platform, setting the stage for success in live options trading.

For those looking to master options trading in a low-pressure environment, Webull’s paper trading offers a practical, accessible, and comprehensive solution.